Introduction

Altcoins Explained, the first name that usually comes to mind is Bitcoin. While Bitcoin was the pioneer that introduced the world to blockchain technology, it is not the only player in the digital asset market. In fact, there are thousands of other cryptocurrencies that exist today, commonly known as Altcoins. These digital currencies have grown in popularity because they offer new features, faster transactions, lower fees, and innovative use cases that Bitcoin does not provide. Visit Now: Wikipedias

This article explores what altcoins are, how they work, why they matter, their types, advantages, risks, and the future of altcoin adoption in the global financial system.

What Are Altcoins?

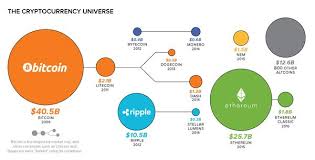

The term Altcoin comes from “Alternative Coin”, meaning any cryptocurrency that is not Bitcoin. Since Bitcoin is considered the first and most dominant digital asset, every other cryptocurrency falls into the altcoin category.

Some altcoins aim to improve Bitcoin’s limitations, such as slow transaction speed and high energy consumption, while others focus on completely different applications, such as smart contracts, decentralized finance (DeFi), NFTs, and gaming.

Popular examples of altcoins include Ethereum (ETH), Ripple (XRP), Cardano (ADA), Solana (SOL), Binance Coin (BNB), and Polygon (MATIC). Crypto Trading Beginner

Why Altcoins Exist

- Bitcoin was revolutionary, but it has limitations. Altcoins were developed to solve these issues and create new opportunities.

- Scalability: Bitcoin can process only a few transactions per second, but altcoins like Solana and Polygon can handle thousands.

- Energy Efficiency: Bitcoin uses Proof of Work (PoW), which consumes massive energy, while altcoins like Ethereum (after its upgrade) and Cardano use Proof of Stake (PoS).

- Smart Contracts: Bitcoin is mainly a payment system, while Ethereum and other altcoins allow developers to build decentralized applications (dApps).

- Lower Fees: Some altcoins provide cheaper transactions compared to Bitcoin.

- Innovation: Altcoins bring new features like privacy coins (Monero, Zcash), stablecoins (USDT, USDC), and meme coins (Dogecoin, Shiba Inu).

Different Types of Altcoins

1. Stablecoins

- These altcoins are pegged to stable assets like the US Dollar to reduce volatility. Examples: Tether (USDT), USD Coin (USDC).

2. Smart Contract Platforms

- Altcoins that allow developers to build decentralized apps and smart contracts. Examples: Ethereum, Cardano, Solana, Polkadot.

3. Meme Coins

- Initially created as a joke, it gained massive popularity. Examples: Dogecoin, Shiba Inu.

4. Privacy Coins

- Focus on anonymity and secure transactions. Examples: Monero (XMR), Zcash (ZEC).

5. Utility Tokens

- Altcoins that serve specific functions on platforms, such as transaction fees or governance. Examples: BNB, UNI, MATIC.

6. DeFi Tokens Altcoins Explained

- Used in decentralized finance ecosystems for lending, borrowing, and trading without banks. Examples: Aave, Compound, Maker.

Advantages of Altcoins

- Diversity of Use Cases: Different coins serve different purposes like payments, lending, gaming, or NFTs.

- Potential for Growth: Many altcoins are in early stages and could multiply in value.

- Faster and Cheaper Transactions: Networks like Solana or Polygon are far more efficient than Bitcoin.

- Technological Innovation: Altcoins push blockchain forward with new ideas and better systems.

- Community Support: Some altcoins have strong global communities that drive adoption.

Risks of Altcoins

- Despite their benefits, altcoins also carry risks.

- Volatility: Prices can rise or fall dramatically within hours.

- Regulation: Governments worldwide are still unclear about crypto rules, which affects altcoins.

- Scams and Fraud: Some altcoins are pump-and-dump schemes with no real value.

- Low Adoption: Many altcoins fail because they don’t gain enough users.

- Security Issues: Smart contracts can have bugs that lead to hacks.

Altcoins vs Bitcoin

| Feature | Bitcoin (BTC) | Altcoins |

|---|---|---|

| First Launched | 2009 | 2011 onward |

| Supply Limit | 21 Million | Varies (many have no limit) |

| Purpose | Digital Money | Payments, DeFi, NFTs, Privacy, etc. |

| Speed | Slow | Faster transactions |

| Energy Use | High (PoW) | Many use PoS (energy efficient) |

| Market Share | ~45% of crypto market | ~55% combined |

The Future of Altcoins Explained

The future of altcoins looks promising. With the rise of Web3, Metaverse projects, decentralized finance (DeFi), and tokenized assets, altcoins are expected to play a bigger role in global finance.

Ethereum’s dominance in smart contracts will keep growing, but rivals like Solana, Avalanche, and Cardano may also capture big market shares.

Stablecoins could become key players in digital payments.

Meme coins might lose hype but continue to exist due to strong communities.

Regulation will shape which altcoins survive and thrive.

Experts believe that the next bull run in crypto will not only be led by Bitcoin but also by strong altcoins with real-world use cases.

Conclusion

Altcoins Explained are much more than just alternatives to Bitcoin. They represent innovation, diversity, and new opportunities in the digital economy. From stablecoins that provide stability to smart contract platforms powering DeFi and NFTs, altcoins are shaping the future of money and technology.

However, investors should research carefully, as the altcoin market is filled with both potential gems and risky projects. As the crypto space evolves, altcoins will play a vital role in driving blockchain adoption worldwide.